Welcome to the first issue of AI for FIs. Each week, this newsletter curates developments in Agentic AI and explains why they matter for credit unions.

How it works: Brent curates links each week, Claude generates summaries and an overview, Brent edits and publishes to Beehiiv.

The AI agent hype is colliding with financial services reality. New research from Neurons Lab shows agentic AI systems often disappoint in regulated environments, with success hinging on implementation rigor rather than model sophistication. Meanwhile, Oliver Wyman warns that AI will fundamentally reshape financial services economics, threatening institutions that merely optimize existing models instead of rethinking member relationships.

Credit unions may face pressure to adopt AI agents fast, but the winners will be those who deploy them carefully. This week's links underscore that tension. Castellum.AI launched compliance agents claiming 94% reduction in false positives for AML screening. Ethan Mollick published a delegation framework for AI that mirrors traditional management principles. Anthropic's Dario Amodei mapped the civilizational risks that will shape AI regulation for years. And practitioners note that trustworthy financial AI requires sandboxed environments and continous improvement just as much, if not more, than more complex models.

We’ll see that a major competitive advantage lies in building evaluation muscle and governance frameworks now, even if you’re not ready to launch an experiment or pilot yet.

Strategic Outlook

oliverwyman.com · Jan 14, 2026

Oliver Wyman analysis finds banks are performing well now, but AI threatens to disrupt traditional business models and revenue sources. The firm argues that financial institutions must leverage trust and reshape their client-facing operations to compete in an AI-dominated future, rather than just optimizing existing models.

Why it matters: Credit unions' competitive position depends on how they position trust and client relationships as AI reshapes member expectations and service delivery models.

Anthropic CEO Dario Amodei outlines the risks humanity faces as AI systems grow more powerful. He argues credit union leaders and policymakers must address dangers carefully and realistically, avoiding both panic and complacency. The essay maps specific risks of advanced AI while calling for measured, evidence-based interventions.

Why it matters: Credit union leaders should understand the civilizational-scale AI risks shaping regulation and industry standards that will eventually affect how FIs deploy AI.

Implementation Guidance

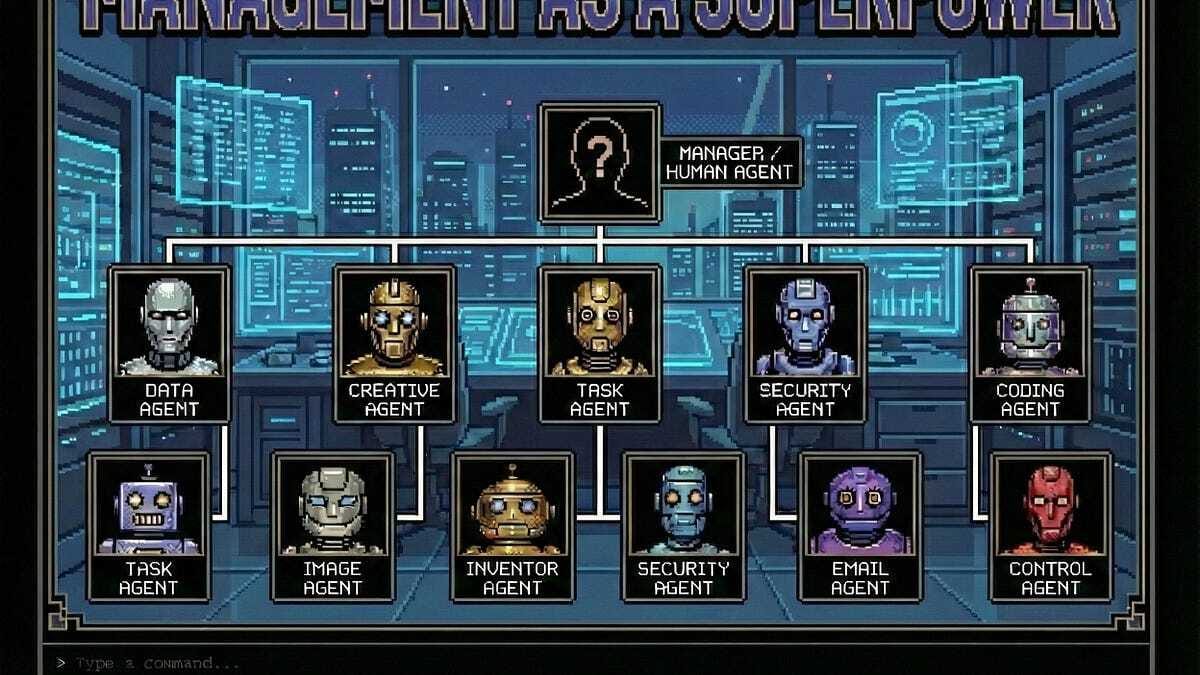

Management expert Ethan Mollick explains the equation for deciding when to delegate work to AI. The key factors are task duration, AI success rate, and evaluation time. Credit union leaders can improve results by using clear instructions and feedback, similar to traditional delegation frameworks.

Why it matters: Credit union executives can apply proven delegation strategies to AI agents, reducing evaluation time and increasing success rates on routine operational tasks.

Financial AI agents need more than smart models to work reliably. They require sandboxed environments, clean data, domain-specific skills, and rigorous testing to stay auditable and trustworthy in high-stakes situations.

Why it matters: Credit unions deploying member-facing AI agents need to focus on safe workflows and strict evaluation, not just model selection, to pass regulatory exams.

Neurons Lab

Research roundup on how agentic AI systems work in banking and financial services. Covers chatbots, training needs, ROI drivers, and when multi-agent systems make sense. Focuses on real implementation challenges in regulated environments.

Why it matters: Credit unions evaluating AI agent investments should understand where these systems create measurable value and where they often disappoint.

Tools

Castellum.AI unveiled agents designed to automate financial crime screening for credit unions and FIs. The platform cuts false positives by 94% and resolves compliance alerts in seconds. It covers sanctions, PEPs, adverse media and transaction monitoring with real-time data updates.

Why it matters: Credit unions can reduce compliance review time by 83% while maintaining audit-ready documentation and regulatory alignment.

🚀 That’s a wrap for issue 1. See you next week. Go get em.

— Brent & the Robots